Who loses from low inflation? What next with the double increase in the minimum wage?

The low inflation announced today by the Central Statistical Office is encouraging because we are all tired of high prices. However, some people benefited from high inflation: this group includes the lowest earners, for whom inflation resulted in two increases in the minimum wage per year, retirees and, to some extent, savers.

The low inflation reading is encouraging because it confirms that the pace of price growth has slowed down. The worst year in this respect was 2022-2023: in February last year, prices increased by 18.4%. compared to the previous year, but this is only an average. The prices of some products increased by half or 40% at the beginning of last year. compared to the previous year. This presented a significant challenge for wallets.

What's next for inflation?

Such low inflation as confirmed today by the Central Statistical Office will not last long: in the coming months it will be pushed up by more expensive food (result of the departure from zero VAT at the beginning of April 2024) and the gradual abandonment of energy shields. Despite this, inflation will not even come close to last year's levels (unless there are some completely unexpected circumstances, of which we unfortunately had no shortage after 2020). Therefore, it is worth remaining optimistic about price changes. Low inflation will certainly make it easier to plan expenses and enable the achievement of goals that previously required saving.

In some respects, however, low inflation is not encouraging. There are people who lose something from it.

Lower interest rates on deposits

Over the last two years, we have been able to find deposit offers at banks at 8-7 percent. on an annual basis. Although it was usually a promotional interest rate and only applied to deposits for several months, we could still get something by transferring money between accounts in different banks. Should I make money? Not necessarily. We recalled that at its peak, inflation exceeded 18 percent, and the interest rate on deposits was at best half of that rate. Keeping money in deposits was an attempt to minimize losses rather than actually making money.

The last few months have been interesting in this respect. Inflation fell below 6% and banks continued to offer deposits at 5%. It can be said that the rapid decline in inflation surprised bankers who did not expect it and did not lower the interest rate table.

However, significant cuts in the tables can be expected in the coming weeks. 5 percent throughout the year it will remain only a pleasant memory.

End of the doubling of the minimum wage

The lowest earners benefited from high inflation. The regulations oblige the government to increase the minimum wage twice a year if the forecast average annual inflation exceeds 5%. That is why in 2023 and 2024, salaries went up not only in January, but also at the beginning of July.

The regulation in question put the lowest-level employees in a good situation: they were guaranteed a raise that protected them against the effects of price increases. Employees whose wages exceed the minimum do not have such protection. The employer is not obliged to increase their wages, although each increase in the minimum wage results in pressure for raises also for other employees.

The minimum wage from January 1, 2024 is PLN 4,242 gross, and the hourly rate is PLN 27.70 gross. In July, the minimum salary will increase to PLN 4,300 gross, and the minimum hourly rate will increase to PLN 28.10 gross. In 2025, the minimum wage will probably increase only at the beginning of January.

Double indexation of pensions

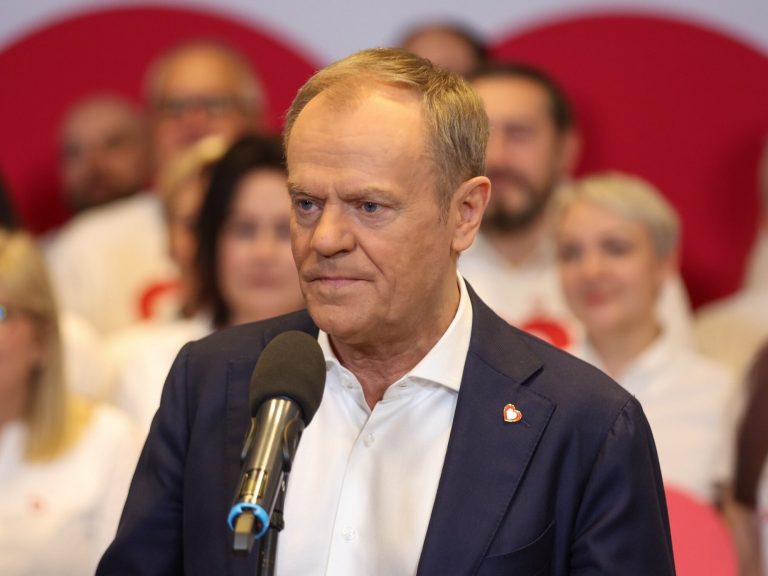

During the election campaign, Donald Tusk announced the introduction of double indexation of pensions if inflation exceeds 5% in the first half of the year. Today, such a mechanism does not apply: retirement and disability benefits are indexed once a year, at the beginning of March. The double indexation proposal is based on double increases in the minimum wage in response to high inflation.

Donald Tusk's proposal may be turned into regulations, but they are unlikely to be applied next year: it is unlikely that the conditions for double indexation will come true.