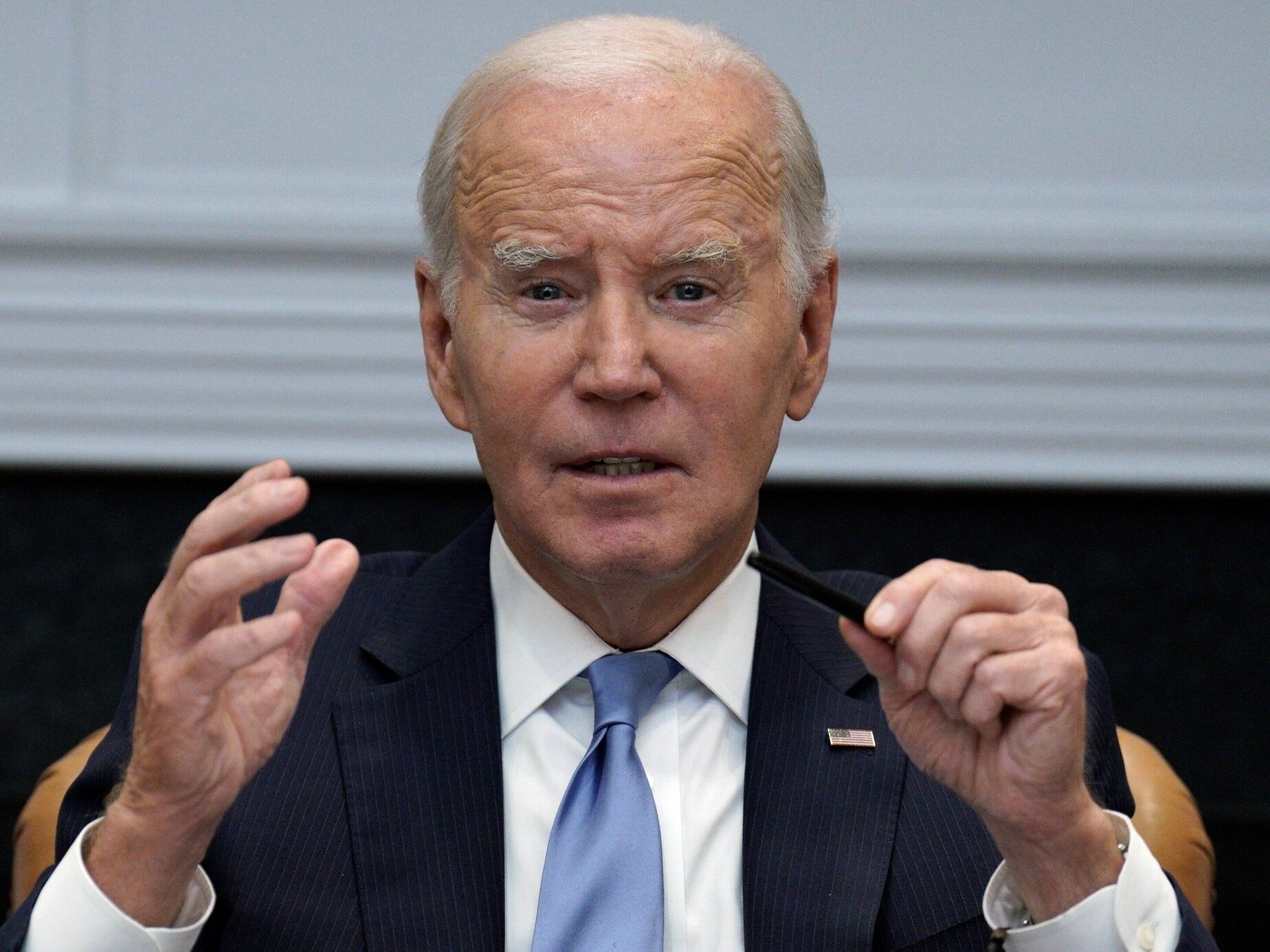

The US economy avoided the worst-case scenario. There will be no “Shutdown”.

Politicians in the United States managed to avoid a shutdown. The state budget can operate under normal conditions again.

The report on American spending, which included the Fed’s preferred measure of inflation, did not surprise in any way. The basic indicator decreased, as expected, and the basic indicator increased. The month-on-month dynamics decreased. The dollar appreciated slightly after the data.

There will be no shutdown in the US

PMIs from China showed a mixed picture of the Middle Kingdom’s economy. In turn, politicians from The US managed to avoid a “shutdown”. The dollar reacted to Friday’s data with moderate strengthening. The EURUSD pair ended Friday’s trading around the opening level, so there was no major breakthrough on the chart of the main currency pair.

Wall Street indexes fell, except for the technology benchmark, which ended the day with a slight gain (0.1%). The market reaction shows that investors are increasingly convinced that interest rates in the US will remain at such high levels for longer, and the date of a potential first reduction from publication to publication is getting further and further away. The weaker month-on-month dynamics of the PCE core index (0.1%) may suggest that the Fed will not raise rates this year.

On the other hand, the year-on-year rate remains at an elevated level of 3.9%. We have also had major revisions to income and spending, meaning households have more in savings than previously thought. It can also be assumed that during the pandemic, citizens simply accumulated more of them than estimated, and in the following months their level was reduced to a lesser extent than expected. We are talking about over USD 700 billion here. This suggests that consumer spending will remain high even if the economic slowdown reaches a more advanced stage.

The feared October 1 US government shutdown is now out of the question as Congress passed temporary funding at the last minute. However, this will only last until November 17. Therefore, the problem will return again in a few weeks. Congressional positions on government spending levels and on issues such as aid to Ukraine and border security remain widely divergent.

Stock exchanges are reacting

On Wall Street, it is possible that we will see some kind of “relief rally” today, but I don’t think it will be spectacular. Over the weekend, we learned the PMI data for China. The official manufacturing index rose to 50.2 in September, the first time since March that it was above the neutral level of 50. This probably reflects the fact that recent stimulus measures, although piecemeal and modest, are having an effect supporting the economy. However, details suggest that most of the improvement was concentrated among large companies, while the activity of medium and smaller companies remained in “shrinkage territory”.

The latter is reflected in the weaker-than-expected Caixin Manufacturing PMI, which fell to 50.6 in September from 51.0 in August. Moreover, the official PMI for the non-manufacturing sector increased to 51.7 in September from 51.0 in August. Meanwhile, Caixin Services PMI unexpectedly dropped to 50.2 from 51.8 previously. The mixed readings suggest that growth stabilization in services is not yet solid.

There is unrest in China

Meanwhile, turmoil in the real estate market will continue to weigh on the economy of the Middle Kingdom. Troubles for China’s most indebted developer have deepened in recent weeks and there is now a greater risk that the company could be forced into liquidation in the coming months. These setbacks could undermine efforts by Chinese authorities to revive homebuyer sentiment through a range of measures, including lowering current mortgage rates and easing mortgage prepayments and restrictions on home purchases. Investors are afraid of the risks associated with other developers and the banking system.